This article provides an overview of the global nanomedicine market, highlighting key players, emerging technologies, and the challenges and opportunities that influence its growth and commercialization in the healthcare sector.

Nanomedicines are nanotechnology-based drug products developed by combining suitable nanocarriers with active pharmaceutical ingredients (APIs) to treat, diagnose, or prevent various diseases.

The U.S. Food and Drug Administration (FDA) defines nanomedicines as products with at least one dimension in the nanoscale range (1–100 nm) that exhibit distinct chemical, physical, or biological properties compared to larger-scale counterparts.

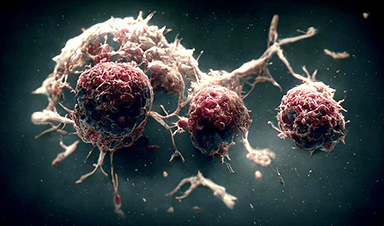

The nanoscale structure and surface properties of nanomedicines enhance drug solubility, stability, selectivity, targeted delivery, and bioavailability, thereby improving efficacy in treating complex diseases such as cancer, cardiovascular disorders, and neurological conditions.1

Market Overview

The global nanomedicine market, valued at approximately USD 189.55 billion in 2023, is projected to exceed USD 562.95 billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.5 % from 2024 to 2033.2

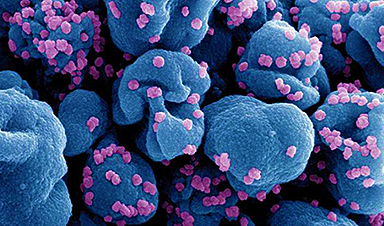

This growth is driven by advancements in nano-pharmaceuticals and the increasing demand for more effective treatments for cancer, immune system diseases, nervous system disorders, and infectious diseases like AIDS.

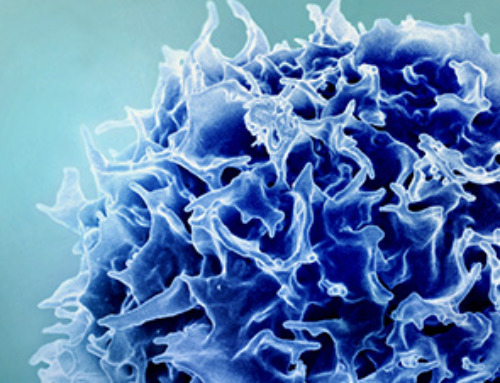

A significant trend in this sector is the focus on personalized medicine, where nano-pharmaceuticals facilitate tailored therapies based on individual genetic profiles. This approach improves treatment outcomes through targeted drug delivery, reducing side effects.

For instance, nanomedicines like Doxil and Abraxane have enhanced efficacy in cancer treatment by selectively targeting cancer cells, minimizing damage to healthy tissues, and lowering toxic side effects.

With over 500 active clinical trials involving nanoparticles and more than 100 FDA-approved nanomedicines, the sector is attracting significant investment from major pharmaceutical companies.3

Key Players in the Nanomedicine Market

Several companies and research institutions are at the forefront of nanomedicine development, driving healthcare innovation through new therapies and diagnostics.

Bristol-Myers Squibb

As one of the world’s largest pharmaceutical companies, Bristol Myers Squibb actively develops nanotechnology-based drug delivery systems. It is a leading patent filer in drug delivery nanoparticles, with a focus on oncology, immunology, hematology, and fibrotic diseases.

The company’s use of liposomes to enhance drug targeting, particularly in cancer treatment, has resulted in innovative formulations like Abraxane, which uses nanoparticle-bound albumin for treating metastatic breast cancer.4,5

Moderna

Moderna, a pioneer in mRNA therapeutics, gained global recognition for developing the COVID-19 mRNA vaccine. Its innovative use of lipid nanoparticles to encapsulate mRNA represents a significant advancement in nanomedicine, providing a framework for future therapies targeting various infectious diseases and cancers.6

Nanobiotix

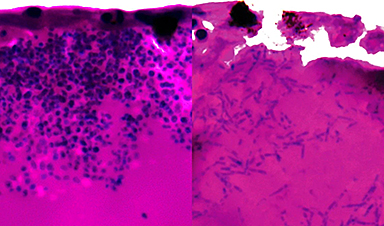

Nanobiotix, a late-stage clinical biotechnology firm based in France, specializes in developing nanotechnology-based treatments for cancer. Its flagship product, NBTXR3, enhances radiotherapy by increasing radiation absorption in tumor cells, improving treatment outcomes with minimal side effects. It is undergoing clinical trials for non-small cell lung and head and neck cancer.7

Generation Bio

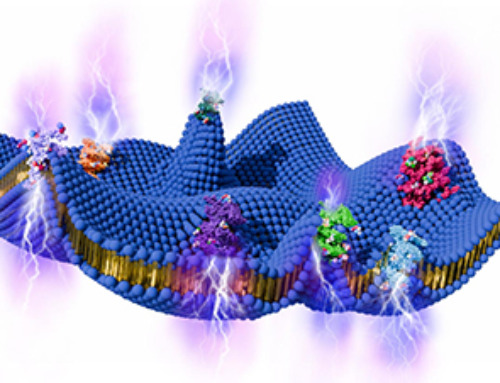

Generation Bio is another key player focusing on genetic medicines. Its proprietary cell-targeted lipid nanoparticle (ctLNP) technology enables selective targeting of therapeutic agents to specific tissues while minimizing off-target effects. This innovative approach has significant potential for in vivo cell therapies, such as reprogramming T cells within the patient’s body.8

Jazz Pharmaceuticals

Jazz Pharmaceuticals is a global biopharmaceutical specializing in oncology and neuroscience. Its FDA-approved product, Vyxeos™, is a liposomal formulation combining daunorubicin and cytarabine, indicated for treating therapy-related acute myeloid leukemia. This liposomal delivery system enhances the efficacy of cancer treatment while reducing toxicity compared to traditional drug administration.9

Cytiva

Other notable players include Ratiopharm, which markets the nanoparticle-bound albumin product Pazenir for various cancers, and Pacira, known for ZILRETTA, the first non-opioid treatment for osteoarthritis knee pain using extended-release microsphere technology.12,13

Recent Developments in the Nanomedicine Market

The nanomedicine market is evolving through several emerging technologies that are reshaping the future of healthcare.

On-Site Production of Nanomedicines for Real-Time Treatments

One of the most promising areas of development is the on-site production of nanomedicines. A recent study by researchers at the University of Oklahoma explored tools designed for producing nanomedicines, including vaccine formulations, directly at the point of care.

This approach addresses the limitations of centralized facilities, shipping challenges, and extreme cold storage requirements experienced during the COVID-19 pandemic.

The research team utilized components from 3D printers to create a T-mixer device that facilitates mixing fluid streams containing nanomedicine building blocks and their payloads.

This innovative system not only enhances the accessibility and efficiency of nanomedicine production but can also revolutionize personalized medicine by enabling real-time production of tailored treatments, ultimately improving patient outcomes and reducing the logistical complexities associated with traditional manufacturing processes.14

World’s First Regulatory Guidelines to Accelerate Clinical Translation

While technological advancements are crucial in nanomedicine, standardized frameworks are equally important for improving development and efficacy.

For example, despite recent successes with chemotherapy and vaccine-based nanomedicines, particularly lipid nanoparticles used in mRNA vaccines during the COVID-19 pandemic, clinical translation remains limited relative to research volume.

To address this, a global team of experts established “the DELIVER guidelines,” the world’s first research quality standards designed to reduce costs and accelerate the development of advanced nanomedicine treatments.

These guidelines offer recommendations across various phases, including design, experimentation, manufacturing, preclinical, clinical, regulatory, and business stages, thus maximizing clinical translation potential.

The DELIVER framework will provide essential principles for researchers, clinicians, and regulatory bodies to navigate translational challenges and minimize delays, facilitating personalized therapies tailored to individual patient needs and offering renewed hope for innovative medical solutions.15,16

Challenges in the Nanomedicine Market

The nanomedicine market faces significant challenges that hinder the transition from research to clinical applications.

Despite extensive studies on nanoformulations, only a small fraction progress to market assessments, with even fewer receiving final approval; reports indicate that less than 10 % of basic scientific research successfully translates into clinical applications. This gap, often referred to as the “valley of death,” makes the shift from laboratory to market costly and time-consuming, ultimately increasing healthcare expenses.

Several factors contribute to these challenges. The discrepancy between the in vivo and in vitro behavior of nanoparticles complicates understanding their clinical effectiveness. Tumor complexity and heterogeneity also hinder nanoformulation efficacy, as different tumors display varying gene expression profiles and drug resistance. Moreover, the multifaceted nature of some formulations adds complexity to the approval process, impeding the advancement of nanomedicines to market.

The threat of failure is significant in this landscape, as exemplified by BIND Therapeutics Inc., which declared bankruptcy in 2013 after its promising anticancer nanomedicine, BIND-014, failed to demonstrate efficacy in larger clinical trials despite initial success.

Opportunities for Growth and Development

Despite these challenges, opportunities for growth and development exist in the nanomedicine sector. The market for nanopharmaceuticals is anticipated to advance over the next five years, driven by innovations in bionanotechnology and nanoengineering. Key drivers for development include the establishment of clearer guidelines for nanotechnology-based drugs, increased government funding, and stronger collaboration between startups and established pharmaceutical companies.

To unlock the full potential of nanomedicines, stakeholders must advocate for adaptable intellectual property and regulatory frameworks tailored to the sector’s unique needs. Additionally, prioritizing long-term strategic planning over short-term gains will be essential for navigating the complexities of the nanomedicine landscape and ensuring successful market integration.17

References and Further Reading

- Shan, X., Gong, X., Li, J., Wen, J., Li, Y., Zhang, Z. (2022). Current approaches of nanomedicines in the market and various stage of clinical translation. Acta pharmaceutica Sinica. B. https://doi.org/10.1016/j.apsb.2022.02.025

- Precedence Research. (2024). Nanomedicine Market Size, Share, and Trends 2024 to 2034. [Online] Precedence Research. Available at: https://www.precedenceresearch.com/nanomedicine-market

- Liu, Q., Zou, J., Chen, Z., He, W., Wu, W. (2023). Current research trends of nanomedicines. Acta Pharmaceutica Sinica. https://doi.org/10.1016/j.apsb.2023.05.018

- Global Data. (2024). Leading innovators in drug delivery nanoparticles for the pharmaceutical industry. [Online] Pharmaceutical Technology. Available at: https://www.pharmaceutical-technology.com/data-insights/innovators-iot-nanoparticles-for-drug-delivery-pharmaceutical/

- Bristol-Myers Squibb. (2021). It’s not all smiles in drug development. [Online] Bristol-Myers Squibb. Available at: https://www.bms.com/life-and-science/science/unusual-liposome-image-during-drug-development.html

- Huang, X., Kong, N., Zhang, X., Cao, Y., Langer, R., Tao, W. (2022). The landscape of mRNA nanomedicine. Nature Medicine. https://doi.org/10.1038/s41591-022-02061-1

- Nanobiotix. (2024). A new standard in radiation oncology. [Online] Nanobiotix. Available at: https://nanobiotix.com/pipeline/

- Generation Bio. (2024). It’s time to unlock the full potential of genetic medicine. [Online] Generation Bio. Available at: https://generationbio.com/our-science

- Jazz Pharmaceuticals. (2022). Understanding treatment with VYXEOS, an advancementa,b in secondary AML therapy. [Online] Jazz Pharmaceuticals. Available at: https://vyxeos.com/

- Cytiva. (2024). NanoAssemblr™ commercial formulation system. [Online] Cytiva. Available at: https://www.cytivalifesciences.com/en/us/shop/lipid-nanoparticle-instruments-and-reagents/nanoparticle-formulation-systems/nanoassemblr-commercial-formulation-system-p-45337?srsltid=AfmBOopKpeQb_v_sVLMmejpjM2IYsBz–Qi79zKTKzDvPPr9L6WDwCgH

- Cytiva. (2024). Unleash The Potential Of RNA-LNPS Together. [Online] Cytiva. Available at: https://www.precisionnanosystems.com/

- European Medicines Agency. (2024). Pazenir. [Online] EMA. Available at: https://www.ema.europa.eu/en/medicines/human/EPAR/pazenir

- Pacira Pharmaceuticals. (2024). A non-opioid option for significant extended relief of OA knee pain. [Online] Pacira Pharmaceuticals. https://www.pacira.com/products/zilretta

- Young, H., He, Y., Joo, B., Ferguson, S., Demko, A., Butterfield, SK., Lowe, J., Mjema, NF., Sheth, V., Whitehead, L., Ruiz-Echevarria, MJ., Wilhelm, S. (2024). Toward the Scalable, Rapid, Reproducible, and Cost-Effective Synthesis of Personalized Nanomedicines at the Point of Care. Nano letters. https://doi.org/10.1021/acs.nanolett.3c04171

- Mansfield, A. (2024). Global experts help nanomedicines DELIVER on healthcare promise. [Online]. The University of South Australia. Available at: https://www.unisa.edu.au/media-centre/Releases/2024/global-experts-help-nanomedicines-deliver-on-healthcare-promise/

- Joyce, P., et al. (2024). A translational framework to DELIVER nanomedicines to the clinic. Nature Nanotechnology. https://doi.org/10.1038/s41565-024-01754-7

- Farjadian, F., Ghasemi, A., Gohari, O., Roointan, A., Karimi, M., Hamblin, MR. (2019). Nanopharmaceuticals and nanomedicines currently on the market: challenges and opportunities. Nanomedicine. https://doi.org/10.2217/nnm-2018-0120

News

Cell Membranes May Act Like Tiny Power Generators

Living cells may generate electricity through the natural motion of their membranes. These fast electrical signals could play a role in how cells communicate and sense their surroundings. Scientists have proposed a new theoretical [...]

This Viral RNA Structure Could Lead to a Universal Antiviral Drug

Researchers identify a shared RNA-protein interaction that could lead to broad-spectrum antiviral treatments for enteroviruses. A new study from the University of Maryland, Baltimore County (UMBC), published in Nature Communications, explains how enteroviruses begin reproducing [...]

New study suggests a way to rejuvenate the immune system

Stimulating the liver to produce some of the signals of the thymus can reverse age-related declines in T-cell populations and enhance response to vaccination. As people age, their immune system function declines. T cell [...]

Nerve Damage Can Disrupt Immunity Across the Entire Body

A single nerve injury can quietly reshape the immune system across the entire body. Preclinical research from McGill University suggests that nerve injuries may lead to long-lasting changes in the immune system, and these [...]

Fake Science Is Growing Faster Than Legitimate Research, New Study Warns

New research reveals organized networks linking paper mills, intermediaries, and compromised academic journals Organized scientific fraud is becoming increasingly common, ranging from fabricated research to the buying and selling of authorship and citations, according [...]

Scientists Unlock a New Way to Hear the Brain’s Hidden Language

Scientists can finally hear the brain’s quietest messages—unlocking the hidden code behind how neurons think, decide, and remember. Scientists have created a new protein that can capture the incoming chemical signals received by brain [...]

Does being infected or vaccinated first influence COVID-19 immunity?

A new study analyzing the immune response to COVID-19 in a Catalan cohort of health workers sheds light on an important question: does it matter whether a person was first infected or first vaccinated? [...]

We May Never Know if AI Is Conscious, Says Cambridge Philosopher

As claims about conscious AI grow louder, a Cambridge philosopher argues that we lack the evidence to know whether machines can truly be conscious, let alone morally significant. A philosopher at the University of [...]

AI Helped Scientists Stop a Virus With One Tiny Change

Using AI, researchers identified one tiny molecular interaction that viruses need to infect cells. Disrupting it stopped the virus before infection could begin. Washington State University scientists have uncovered a method to interfere with a key [...]

Deadly Hospital Fungus May Finally Have a Weakness

A deadly, drug-resistant hospital fungus may finally have a weakness—and scientists think they’ve found it. Researchers have identified a genetic process that could open the door to new treatments for a dangerous fungal infection [...]

Fever-Proof Bird Flu Variant Could Fuel the Next Pandemic

Bird flu viruses present a significant risk to humans because they can continue replicating at temperatures higher than a typical fever. Fever is one of the body’s main tools for slowing or stopping viral [...]

What could the future of nanoscience look like?

Society has a lot to thank for nanoscience. From improved health monitoring to reducing the size of electronics, scientists’ ability to delve deeper and better understand chemistry at the nanoscale has opened up numerous [...]

Scientists Melt Cancer’s Hidden “Power Hubs” and Stop Tumor Growth

Researchers discovered that in a rare kidney cancer, RNA builds droplet-like hubs that act as growth control centers inside tumor cells. By engineering a molecular switch to dissolve these hubs, they were able to halt cancer [...]

Platelet-inspired nanoparticles could improve treatment of inflammatory diseases

Scientists have developed platelet-inspired nanoparticles that deliver anti-inflammatory drugs directly to brain-computer interface implants, doubling their effectiveness. Scientists have found a way to improve the performance of brain-computer interface (BCI) electrodes by delivering anti-inflammatory drugs directly [...]

After 150 years, a new chapter in cancer therapy is finally beginning

For decades, researchers have been looking for ways to destroy cancer cells in a targeted manner without further weakening the body. But for many patients whose immune system is severely impaired by chemotherapy or radiation, [...]

Older chemical libraries show promise for fighting resistant strains of COVID-19 virus

SARS‑CoV‑2, the virus that causes COVID-19, continues to mutate, with some newer strains becoming less responsive to current antiviral treatments like Paxlovid. Now, University of California San Diego scientists and an international team of [...]